What Expenses Cannot Be Capitalized . Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. Some examples of incurred expenses are:. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. therefore, unlike capitalized costs, the expense is not represented over time.

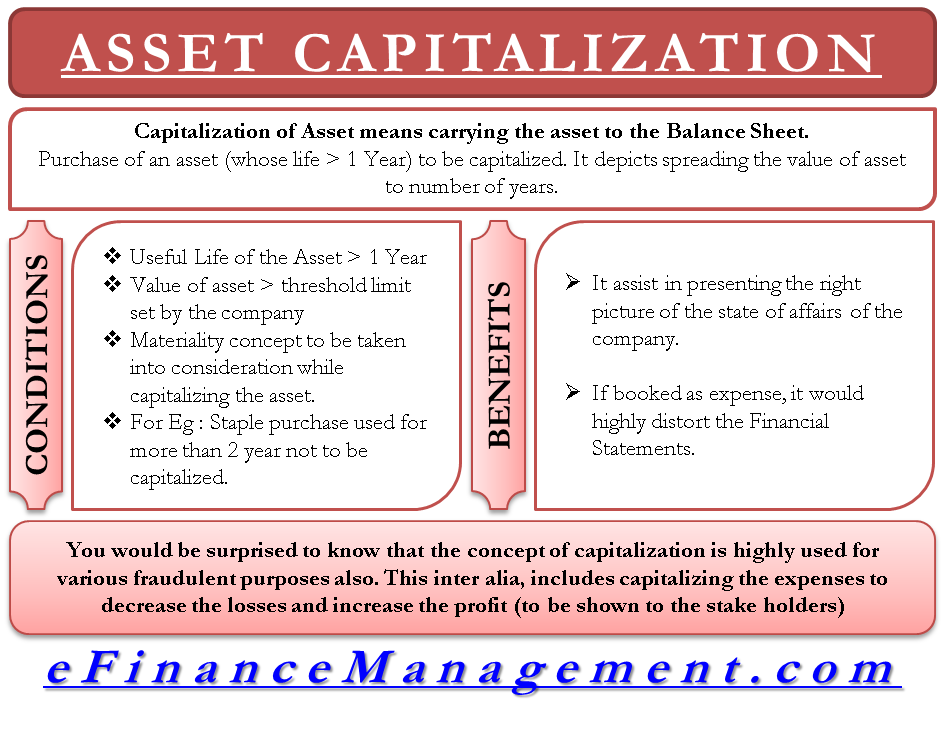

from efinancemanagement.com

Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. Some examples of incurred expenses are:. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. therefore, unlike capitalized costs, the expense is not represented over time. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption.

Capitalizing Assets Define, Example, Matching Concept, Fraud, Benefits

What Expenses Cannot Be Capitalized — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. Some examples of incurred expenses are:. therefore, unlike capitalized costs, the expense is not represented over time. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption.

From www.pinterest.com

Capital Expenditure Capital expenditure, Accounting education What Expenses Cannot Be Capitalized — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. therefore, unlike capitalized costs, the expense is not represented. What Expenses Cannot Be Capitalized.

From www.slideteam.net

Capitalized Expenses Real Estate In Powerpoint And Google Slides Cpb What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance,. What Expenses Cannot Be Capitalized.

From einvestingforbeginners.com

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation What Expenses Cannot Be Capitalized Some examples of incurred expenses are:. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. therefore, unlike capitalized costs, the expense is not represented over time.. What Expenses Cannot Be Capitalized.

From www.youtube.com

Capitalized Cost vs Expenses YouTube What Expenses Cannot Be Capitalized — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. Some examples of incurred expenses are:. an expense is said to be capitalized when its benefits do. What Expenses Cannot Be Capitalized.

From accountingforeveryone.com

When to Capitalize Instead of Expense a Purchase Accounting for Everyone What Expenses Cannot Be Capitalized — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Some. What Expenses Cannot Be Capitalized.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting What Expenses Cannot Be Capitalized — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. therefore, unlike capitalized costs, the expense is not represented over time. Initially, the expense is not recognized. What Expenses Cannot Be Capitalized.

From thetaxtalk.com

Expenses cannot be disallowed merely due to nonpayment of What Expenses Cannot Be Capitalized Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. Some examples of incurred expenses are:. therefore, unlike capitalized costs, the expense is not represented over time.. What Expenses Cannot Be Capitalized.

From thecontentauthority.com

Capitalized vs Expensed Which One Is The Correct One? What Expenses Cannot Be Capitalized Some examples of incurred expenses are:. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. an expense is said to be capitalized when its benefits do. What Expenses Cannot Be Capitalized.

From slideplayer.com

©2010 Pearson Education, Inc. Publishing as Prentice Hall ppt download What Expenses Cannot Be Capitalized Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. therefore, unlike capitalized costs, the expense is not represented over time. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — to capitalize is to. What Expenses Cannot Be Capitalized.

From corporatefinanceinstitute.com

R&D Capitalization vs Expense How to Capitalize R&D What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance,. What Expenses Cannot Be Capitalized.

From www.slideserve.com

PPT Financial Reporting PowerPoint Presentation, free download ID What Expenses Cannot Be Capitalized — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. therefore, unlike capitalized costs, the expense is not represented. What Expenses Cannot Be Capitalized.

From investguiding.com

Capital Expenditure (CapEx) Definition, Formula, and Examples (2024) What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. therefore, unlike capitalized costs, the expense is not represented over time. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of. What Expenses Cannot Be Capitalized.

From einvestingforbeginners.com

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation What Expenses Cannot Be Capitalized therefore, unlike capitalized costs, the expense is not represented over time. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words,. What Expenses Cannot Be Capitalized.

From efinancemanagement.com

Capitalizing Versus Expensing Costs What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. Some examples of incurred expenses are:. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Initially, the expense is not recognized on the income statement, as it. What Expenses Cannot Be Capitalized.

From einvestingforbeginners.com

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. Some examples of incurred expenses are:. — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. — to capitalize. What Expenses Cannot Be Capitalized.

From slideplayer.com

Session 7 Estimating cash flows ppt download What Expenses Cannot Be Capitalized — expenses that must be taken in the current period and cannot be capitalized include utilities, insurance, office supplies, and any item that's under. — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. . What Expenses Cannot Be Capitalized.

From www.slideserve.com

PPT Perspective on Investing PowerPoint Presentation ID1853433 What Expenses Cannot Be Capitalized — the capitalize vs expense accounting treatment decision is determined by an item’s useful life assumption. Initially, the expense is not recognized on the income statement, as it is capitalized as an asset. an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. . What Expenses Cannot Be Capitalized.

From slideplayer.com

By G NARENDRAN ACA.,ACMA., CS ppt download What Expenses Cannot Be Capitalized an expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting. — to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. Initially, the expense is not recognized on the income statement,. What Expenses Cannot Be Capitalized.